Financial Education Things To Know Before You Buy

Wiki Article

3 Easy Facts About Financial Education Described

Table of ContentsFinancial Education for DummiesThe Single Strategy To Use For Financial EducationSome Known Incorrect Statements About Financial Education Getting My Financial Education To WorkOur Financial Education IdeasSome Known Details About Financial Education The Best Strategy To Use For Financial Education

This is their intro to the financial world. Most think that an individual's monetary journey starts when they begin with their adult years, but it starts in childhood years. Kids these days have simple access to almost any kind of sources, whether it is cash or some asset that money can get. This did not exist in the older generation, where also when resources were readily available, they did not have actually points handed to them.Asking your moms and dads for costly presents like an i, Phone, Mac, Publication, or Apple Watch, and afterwards throwing tantrums over it reveals how you are not all set for the globe around. Your parents will certainly attempt to explain this to you, however youngsters, particularly teenagers, rarely comprehend this. Otherwise taught the importance of believing seriously before investing, there will certainly come a time when the next gen will certainly deal with issues, and also not discover exactly how to take care of financial resources as an adult.

Early learning of ideas like the value of worsening, the difference between wants and needs, postponed gratification, opportunity cost and also most notably duty will hold the next generation in good stead. Best Nursing Paper Writing Service. Worths of properties and cash can not be taught overnight, therefore starting young is crucial. Simply put, whether you like it or not, monetary monitoring slowly becomes an integral component of life, and the sooner one begins instilling the routine; the earlier they will certainly master it, and also the much better prepared they will certainly be.

Not known Details About Financial Education

If, nevertheless, it is made necessary in colleges or educated by moms and dads at residence, the benefits would be extensive: 1. Capacity to make far better financial decisions 2.

Financial Education Can Be Fun For Everyone

Moms and dads always consider making certain to maintain enough cash for their kids, nevertheless, they fall short to comprehend that one even more step should be included their future preparation for their kids. They have to instill the essentials of money in young ones prior to they head out into the world independently since doing so will certainly make them a lot more liable and make their life far much more hassle-free! Views expressed over are the writer's own.And you regularly pay attention to your general portfolio more information earnings, financial savings and also investments. You likewise understand what you don't recognize, and also you ask for assistance when you need it. Handling your money needs continuous attention to your spending and also to your accounts and also not living past your financial means.

Fascination About Financial Education

You will miss out on out on interest created by a financial savings account. With cash in an account, you can start spending.You require to see specifically just how you're spending your money as well as identify where your financial holes are. 1. Beginning tracking your regular monthly expenses In a note pad or a mobile application, create in every single time you spend cash. Be diligent about this, due to the fact that it's very easy to fail to remember. This is the structure for your budget.

And also which ones can you truly do without? Be truthful, and begin cutting. This is the start of the difficult decisions.

The 10-Minute Rule for Financial Education

Consider cost savings A crucial component of budgeting is that you ought to constantly pay on your own initially. That is, you must take a portion of every paycheck as well as put it into savings. This practice, if you can make it a habit, will certainly pay returns (essentially in a lot of cases) throughout your life.Now establish your budget plan Beginning making the necessary cuts in your repaired as Read More Here well as variable expenses. The leftover money is exactly how much you have to live on.

Debit cards have advantages like no limitation on the quantity of deals and also rewards based upon constant usage. You have the ability to invest without lugging cash money and the cash is quickly withdrawn from your account. Due to the fact that utilizing the card is so simple, it is important that you don't spend beyond your means and lose track of just how frequently you're spending with this account.

Rumored Buzz on Financial Education

Some resorts, car rental firms and various other businesses require that you make use of a pop over to these guys charge card. Obtaining an account developed for periodic use can be a wise choice. You can establish your credit report history as well as take advantage of the moment buffer in between purchasing and also paying your costs. One more advantage of making use of credit score is the included defenses used by the provider.Relying on a charge card can result in taking on significant financial debt. Ought to you pick to have a charge card, the most effective approach of action is paying in complete every month. It is most likely you will currently be paying interest on your purchases as well as the more time you carry over an equilibrium from month to month, the even more rate of interest you will pay.

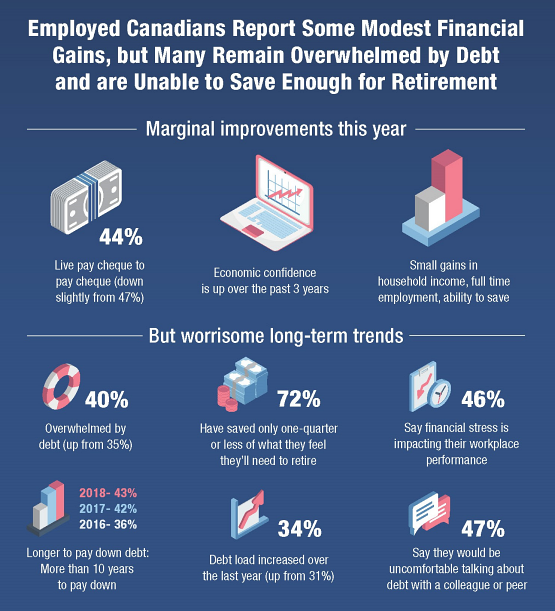

The report likewise said the typical customer has a bank card equilibrium of $5,897. Complete Financial Obligation for American Consumers = $11. 74 trillion Financial specialist Chip Stapleton offers a smart strategy to obtain and remain out of debt that anybody can practice. A credit history can be a strong indicator of your monetary well-being.

Some Known Questions About Financial Education.

You can acquire a duplicate of your debt report free of cost once each year from each of the credit rating bureaus. Building a high credit report can help you obtain authorization for low-interest fundings, charge card, home mortgages, and also auto repayments. When you are looking to relocate into a house or obtain a brand-new work, your credit rating might be a deciding element.Report this wiki page